With a changing market, how you sell your home in Sydney now is very different from a year, even six months ago.

Here’s everything you need to know about the current market – and with the right preparation and pricing, you can still achieve a successful sale.

Understanding the current market

While the news might be making it seem like we’re heading for a crash (we’re not), we are seeing a change.

For the past few years, we’ve been in a seller’s market.

Essentially that means we had more buyers than the amount of homes for sale. That meant sellers had the power and homes tended to sell quickly and for higher prices.

The reason is we had historically low listings. For various reasons, homeowners weren’t selling.

And as we know, life most often drives moves. Despite the government’s attempts to curb price growth with higher interest rates, people were still buying homes. Therefore buyers were competing on less homes and pushing up prices.

The shift to a buyer’s market

For the past two quarters, we’ve seen an increase in the number of listings.

There could be a number of reasons including too much cost of living pressure with the increased interest rates, or simply that homeowners have held out long enough and need to move for life reasons.

So the supply and demand has shifted to more listings for the same number of buyers.

We’re seeing this in lower auction clearance rates, longer days on market and overall price decline in Sydney.

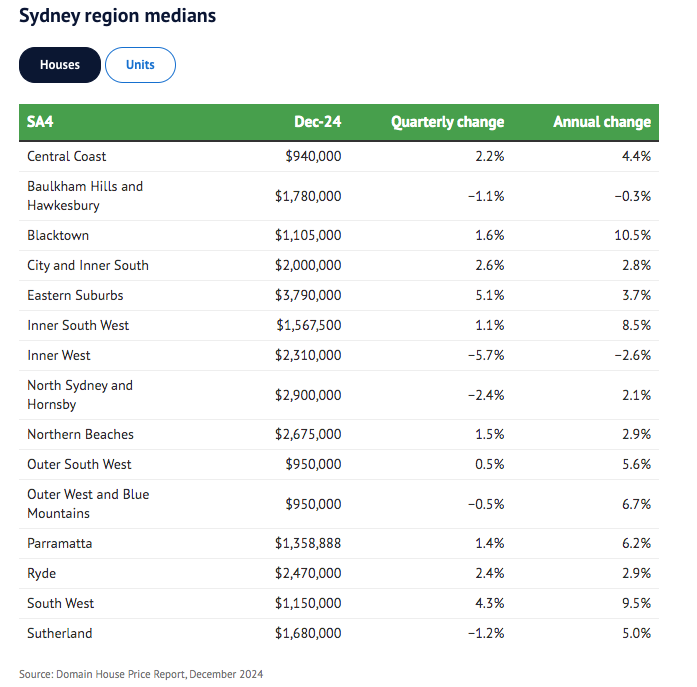

However, it should be noted that many areas are still increasing in value, just at a slower rate as shown in this chart.

This is an early sign of a buyer’s market, which usually starts at the top end (luxury).

As affordability decreases, buyers change their budget to a lower price point, trickling down until (typically) first home buyers are priced out of the market.

So while some areas are continuing to see growth, the longer we are in this market, the more areas and price points will see a decline.

Unique opportunity for upsizers

You know the phrase “buy low, sell high”? Well it’s actually pretty rare because most people are buying and selling in the same market.

However, here’s a very unique (and likely short-lived) opportunity, particularly for upsizers.

As I explained, because we are shifting into a buyer’s market, some areas of the market are still strong with seller’s market-like conditions. That’s typically in homes on the lower end or that are attracting first time home buyers.

So if you currently live in a home and looking to buy a more expensive home, you can likely sell high (before it shifts to a buyer’s market) and buy low (where it’s already shifted to a buyer’s market) right at this moment.

Basically there’s more competition for buyers to purchase your home than there is for you to buy your next home.

But – pay attention to my next point.

This buyer’s market could be short lived

If the rumored interest rate drops happen this year, affordability will improve, attracting more buyers and then higher prices again.

Generally, seller’s markets are triggered by lower interest rates. Buyers can afford more, but also people generally think lower interest rates mean it’s a better time to buy (even though the data shows prices actually go up).

Forecasts are for at least one interest rate cut this year and as early as February, so your opportunity window might be closing soon.

Be strategic in a buyer’s market

Since we don’t have a crystal ball on this year’s interest rates, let’s assume that we will move into a buyer’s market among all Sydney suburbs and price points. Here’s what to do if you want to sell your home:

Price it right

Generally, sellers are the last to adapt to a buyer’s market. It’s a hard truth that your home may not be worth what it once was just one year ago.

But overpricing could lead to your home sitting on the market longer, a cancelled auction and buyers wondering “what’s wrong with it?” when it’s simply that the original price turned off buyers.

Not only that, beware of agents overquoting your home to win the listing. Many agents will then turn around and tell you to price considerably lower saying “the market has changed”.

Research recent sales

Now more than ever, it’s important to do your own market research for what your property is currently worth.

Try to use comparable sales data from the last month, ideally the more recent the better. That’s because in the early stages of a shift, the data from even three months ago won’t be accurate.

If you have to use older sales data (like maybe you have a unique property), then you’ll want to shave money off those prices to get your accurate current value.

Have realistic expectations

Understand that homes are taking longer to sell so you might have a longer sales campaign (including more inspections) and the home might sell for less than you expected.

Auction clearance rates are also lower which can either indicate that sellers are setting the reserves too high, there aren’t enough bidders at auction, or agents are privately negotiating with buyers.

You may need to be flexible with when and how your home is sold.

Prepare for buyer feedback in a buyer’s market

Because there is more choice on the market, buyers can be pickier.

They will scrutinize properties more closely, including the building and pest report. What might have been OK before (such as termites), might be a deal breaker now.

Also expect more critical feedback from the inspections. Buyers may comment on the price, condition and potential renovations.

Be proactive

One way to reduce the amount of buyer feedback is to address potential objections before your home hits the market.

Walk through your home with fresh eyes and take note of what buyers might see that could be a turnoff.

Then make any needed repairs, update the condition and refresh the style to appeal to buyers.

This is when market research can also be helpful. Look at what’s currently for sale in your area and ideal price point. Examine the pictures and take note of the condition, as well as features you might be missing. You may even want to attend the opens in person to see what your potential buyer is seeing and may compare to your home.

Pre-Sale Renovations

Along with addressing potential objections, it’s also important to understand today’s buyers.

With the price of homes, most Sydney buyers need to be dual income (and with that, making well above the average income. If you’re curious what it is for your suburb, here’s a good chart). That means they’re busy and likely don’t have the time or money (on top of the deposit and stamp duty) to renovate.

So do the renovations for them.

You will attract more buyers this way. In general, improving the condition will get you more money, whether that’s keeping your sale price what it would have sold for last year or increasing in value.

When considering pre-sale renovations, check your return on investment to make sure that you’ll be making a profit and not overcapitalising.

The other thing to know about pre-sale renovations is that it might mean adding features that are missing.

For example, in the Sandringham pre-sale renovation, I discovered that all of the comparable sales in our ideal price point had an outdoor kitchen. Since I knew the same buyers would be inspecting those homes and would likely notice we were missing this feature, I made sure to add one (on a budget).

Marketing matters more than ever

Now that you’ve made your home look its best, you also need to attract the buyers before they step foot in your home.

With more listings to choose from and a limited time for inspections, buyers will be choosier about which homes they will see.

To stand out online (where most buyers will see your home first and decide to attend an inspection), great staging, professional photography and video are a must.

In addition, social media is more important than ever, especially if your buyer is a Millennial or Gen Z. Unfortunately, the traditional real estate agent “just listed” and video featuring your agent introducing people to “x address” will not attract these buyers.

A great social media campaign includes Reels, TikToks and photos that sell the lifestyle, not just the house.

Before you hire your agent, check out their social media profiles. And make sure you understand whether they will charge you any fees to post.

Buy or Sell your home first?

Since most home sellers also need to buy, it can be a good strategy to consider the order you buy and sell your home.

For most people, your individual situation as well as appetite for risk will probably determine which move happens first.

But here’s some scenarios to consider:

- If you’re in the unique opportunity to sell high, buy low it might be worth selling first. This protects your home from losing more value, plus on the buy side prices might continue to go down.

- If the Reserve Bank of Australia announces a rate drop that could mean more buyers in the market which is great for your sale but might mean more competition when you buy. If it looks like this might happen, then you might choose to buy first to avoid the influx of buyers plus give it time to accumulate buyers on the sale side.

- A buyer’s market usually means more negotiating power for buyers. You may be able to get a longer settlement, as well as more favourable terms like a lower deposit or a conditional sale.

- Keep in mind that if you do the work to prepare your home for sale and you price right, you can be the exception and have a quick sale with a high sale price.

Work with the right team

It’s always important to pick the right real estate agent (and potentially buyer’s agent) but now it’s important to ensure a successful sale.

As I’ve mentioned, be wary of real estate agents who overquote on your home’s value in order to win the listing.

Do your own market research or you can hire someone independent like a property valuer, vendor’s advocate or a pre-sale renovation specialist (like me).

In addition, it’s good to have someone who’s been in the industry long enough to have experienced a previous shift to a buyer’s market so they can strategize on price and navigating the market changes.

And finally, pay attention to their marketing plan. Look at previous listings including the quality of photos, video and any other material. If you were a buyer, would the home be a must-see? If it’s lacking, including their social media marketing, you might want to find another agent.

Consider a buyer’s agent

I know it’s more money out of pocket, but a buyer’s agent might actually help you save money or make a smart decision.

Similar to your real estate agent, choose a buyer’s agent who’s been through a buyer’s market shift before.

That’s because they can help you determine what exactly the property you want to buy is worth. Just because there’s a price guide, doesn’t mean that’s it in line with the current market.

A good buyer’s agent will guide you on the true market value and will be helpful in any sale condition – whether it’s at auction competing with other buyers or private negotiations with a sales agent who’s job is to get the most amount of money for their client.

A seasoned buyer’s agent will also help you navigate the market to ensure you’re buying an asset that will increase in value.

How a pre-sale renovation specialist can help

A pre-sale renovation specialist like Wealth House can take away all the guesswork and time it takes to research what will add value and attract the most amount of buyers.

My Sandringham NSW pre-sale renovation, for example, added $370,000 in value to the property and sold at auction in 3 weeks. Nearby homes that went on the market at the same time still haven’t sold 7 months later, even after multiple price reductions and agent changes.

I can help through a consultation or even full-service project management.

Conclusion: leverage today’s market to sell your home

Despite the news and what a buyer’s market typically means, you CAN have a successful home sale.

Whether you retain your home’s value OR you increase it by:

- Eliminating potential objections before you go on the market

- Doing your own market research & having realistic expectations on price

- Exploring pre-sale renovations to attract more buyers

- and Having a strong marketing campaign, especially for digital (where most buyers see your home first)

You’ll be able to attract the most amount of buyers, potentially creating a bidding war at auction.

Plus, consider that this could be an opportunity for you on the buy side, especially if you act before any interest rate drops this year.

If you want my help, I offer consultations where I can give you personalised feedback on what work is worth doing before you list, as well as your home’s current value and it’s full potential. From there, I can also project manage all the renovations and even offer a renovate now, pay at settlement program.

Book your consult here.